For a long time, crypto investors saw taxes as a once-a-year hassle – something they could sort out with spreadsheets and a bit of guesswork. But as regulators tightened the rules and exchanges began sending reports straight to tax authorities, everything changed. By 2025, the mindset of “I’ll figure it out later” no longer works. Today, the real challenge isn’t just calculating gains – it’s doing it correctly, quickly, and without handing over more money to the tax office than necessary.

Introduction: The Tax Side of Crypto Investing

Taxes are seldom the most thrilling aspect of crypto, but they have a way of turning profitable years into nightmares. With the growing digital economy, governments globally have began imposing sharper, tougher crypto taxation laws – and they often catch investors unarmed.

Why crypto taxation became a major issue in 2025

In 2025, a number of key tax authorities – such as the IRS, HMRC, and the EU DAC8 framework – imposed stricter compliance requirements for digital assets. Exchanges are now required to report users’ histories of activity, with inconsistencies consequently easier to identify. Suddenly, what had been “optional transparency” became a matter of legal formality.

This regulatory imperus was a manifestation of how disunified most investors’ records had become. Individuals trading across several exchanges or dealing with DeFi protocols couldn’t even report their cost basis or their realized gains comprehensively.

| Area | Mergers and | Key Change |

| United States | IRS Form 1099-DA | Exchanges must report digital asset transactions |

| European Union | DAC8 Directive | Forced cross-border data exchange information sharing |

| United Kingdom | HMRC Crypto Asset Manual Update | Elongated descriptions of “staking rewards” and “disposal” |

| Australia | ATO Integration Program | Direct linking of wallet data with tax ID files |

“It is not a question of penalty,” stated a financial auditor during a Bloomberg interview. “It is standardization. Governments are asking for clean data – and crypto investors must provide clean data.”

Consequently, tax preparation has become no longer a post-season rush but a perennial process involving continuous tracking and organized data.

How manual reporting often leads to overpayment

Most individual investors are still using manual approaches – exporting trade history, working out gains in a spreadsheet, and rounding figures that never seem to tally. The issue is not motivation, but variability. Small variations in timestamps or cost-basis logic can convert true figures into overstated liabilities.

Common manual-reporting mistakes:

- Double-counted disposals in case an asset is transferred between the wallets.

- Inaccurate cost basis as a result of inconsistent FIFO/LIFO basis.

- Ignored network fees, which are often deductible but missed.

- Unreported airdrops or staking income, improper handling as capital gains.

- Overlooked DeFi trades, with taxable events not recorded. Here’s how they add up to small mistakes:

Here is how the little errors add up:

| Mistake Type | Example | Typical Result |

| Asset transfer between portfolios | Transferring BTC from Coinbase to Ledger | Taxed twice as “sale” and “purchase” |

| Tradedetiots trading fee | $20 per trade 100 trades | $2,000 unclaimed deductions |

| Wrong FIFO/LIFO | Changing order of sales | 5–10% variation in taxable income |

| Excluded DeFi staking | 12% yearly return unreported | Late penalties and audit risk |

A 2024 PwC report predicted that almost 38% of active cryptocurrency investors paid 8% or more in tax due to incorrectly stated transactions. They often lose money unnoticed – not due to investors’ dishonesty, but data madness that leaves precision almost inevitable.

The rise of automation as the only scalable solution

As portfolios increase and transactions grow many times across chains, manual accounting just can’t catch up. Automation – via portfolio monitoring and tax calculation tools – is proving the only scalable countermeasure against human fallibility.

Automatic systems extract wallet data, exchanges, and block explorers, categorize them based on tax entities, and compute unrealized and realized gains programmatically. Rather than rummage through CSV exports, users receive formatted outputs prepared for tax filing.

| Process | Manual Effort (Hours) | Automated Effort (Minutes) | Accuracy Level |

| Trade import & matching | 10–15 | 1–2 | 95–99% |

| Cost-basis computation | 4–6 | <1 | 99% |

| Reporting format generation | 5+ | Instant | 100% consistent |

“The gimmick was not tracking per se,” remarked a tax professional that changed clients to auto systems in 2025. “It was the reconciliation of each chain, wallet, and exchange without keying. That alone decreased errors and overpayments.”

Automation doesn’t abdicate responsibility – investors still must look at and approve classifications – but it significantly reduces the room for errors. As the tools mature, crypto tax accounting is getting closer to traditional financial standards: ongoing monitoring, standardized basis in cost, and machine-readable reports.

The following section looks at the top issues that make crypto tax accounting particularly difficult – and why the fix can’t just be a piece of software.

Key Challenges in Crypto Tax Accounting

Crypto tax accounting is often less about crunching numbers and more about playing detective. With constant activity across wallets, exchanges, and blockchains, keeping tidy records manually is next to impossible. Even seasoned investors can misreport earnings due to one overlooked transfer or an incorrectly tagged staking reward. Here’s a breakdown of the biggest hurdles every crypto investor faces when it comes to taxes.

Tracking cost basis across multiple wallets and exchanges

Figuring out your cost basis – what you originally paid for a crypto asset – might sound simple, but in practice, it’s anything but. Each trade, transfer, or token swap adds another layer of confusion. Once your transactions are scattered across several platforms and wallets, maintaining a clear and consistent acquisition record becomes a nightmare.

When inconsistent data creates double-taxation scenarios

One common issue arises when investors move tokens between their own wallets. If these transfers aren’t labeled properly, tax software (or the tax authorities) might treat them as a taxable sale on one end and a new purchase on the other – essentially taxing you twice for the same asset.

| Scenario | Cause | Tax Outcome |

| Transferring ETH from Binance to MetaMask | No “transfer” tag applied | Taxed as disposal + repurchase |

| Migrating tokens during chain upgrade | New contract address not recognized | Reported as gain event |

| Airdrop claim followed by wallet move | Timestamp mismatch | Two taxable events created |

| Cross-exchange arbitrage | Separate APIs mislabel source | Duplicate trades appear |

To avoid this, transactions must be properly tagged and reconciled – identifying internal transfers versus actual sales. But without automation, most investors lack the tools to manage this nuance.

How FIFO/LIFO misalignment affects final liabilities

Different countries follow different accounting methods for calculating gains. The most common are FIFO (First In, First Out) and LIFO (Last In, First Out). Using the wrong method – or a mix of both – can significantly change your taxable outcome.

| Example | FIFO Result | LIFO Result |

| Buy 1 BTC at $20,000, another at $30,000; sell 1 BTC at $35,000 | $15,000 gain | $5,000 gain |

The problem gets worse when data exported from different exchanges doesn’t clarify which method they’ve used. Some default to FIFO; others list trades in raw chronological order. When combined manually, the end result may be a cost-basis mix-up that regulators could challenge or reject.

Realized vs. unrealized gains confusion

Understanding the difference between realized and unrealized gains seems easy until you consider staking, wrapping, or farming. In crypto, a token might earn returns or change form (like wrapped assets) without ever being sold – yet that might still count as taxable. Deciding what qualifies and when it counts is one of the murkiest areas in today’s crypto tax rules.

The importance of transaction classification

How you classify a crypto event – as income, capital gains, or something else – determines how it’s taxed. But DeFi often blurs the lines: staking rewards can resemble interest, yield farming may involve multiple assets, and governance tokens sometimes drop in unannounced.

| Transaction Type | Tax Classification | Notes |

| Spot trade (BTC → ETH) | Capital gain/loss | Triggered at time of sale |

| Staking reward | Ordinary income | Based on market value at receipt |

| Yield farming return | Income or capital gain | Depends on structure |

| NFT mint sale | Business income | If part of a regular activity |

| Token swap (bridge/wrap) | Often capital event | Requires accurate valuation records |

“The real challenge isn’t the math – it’s the labeling,” a crypto-specialized CPA noted. “Misclassifying income as capital gain can mean overpaying or underreporting.”

Accurate labeling relies on timestamps, transaction hashes, and protocol metadata – all of which vary wildly across chains, adding yet another layer of complexity.

How DeFi and NFTs complicate reporting

DeFi takes the difficulty up a notch. Smart contracts often don’t provide direct pricing data, which leaves investors guessing the fair market value during transactions.

NFTs are even trickier. Whether a mint or a resale counts as collectible income or business revenue depends on local tax laws – and the investor’s intent. With hundreds of microtransactions like gas fees and royalty payments involved, tracking manually is nearly impossible.

| Asset Type | Common Pitfall | Example Consequence |

| DeFi Liquidity Tokens | Ignored impermanent loss | Overstated ROI |

| NFT Flips | Missing cost basis for mint | Underreported gain |

| Bridged Assets | Duplicate reporting | Inflated income |

| Reward Compounds | Mixed income/gain classification | Wrong category totals |

Even the best automated tools need help – such as consistent wallet labels and user reviews – to ensure local tax rules are applied correctly.

Compliance and record retention requirements

Regulators now demand much more than an annual summary. Today, investors must keep detailed records – including timestamps, wallet addresses, and fiat values – for every transaction, and store them in formats like CSV or XML for up to seven years.

What tax authorities now demand from investors

Across major jurisdictions, the following documentation is now expected:

- Full transaction logs with timestamps, wallet addresses, and fiat conversions

- Clear audit trails connecting every inflow and outflow to a wallet or exchange

- Consistent cost-basis methodology applied across all activity

- Retention of records for 5–7 years, even after taxes are filed

| Jurisdiction | Retention Period | Required Format | Enforcement Level |

| USA | 7 years | CSV / 1099-DA | High |

| UK | 5 years | HMRC-standard ledger | High |

| EU | 6 years | DAC8 XML schema | Medium–High |

| Canada | 6 years | CRA digital logs | Medium |

This growing standard makes centralized data storage not just useful – but necessary.

Why centralized logs are both a benefit and a risk

Keeping all your crypto tax records in one place helps reduce errors – but it also creates a potential security risk. If an account is compromised, years of financial data could be exposed.

To counter this, modern tracking platforms use tools like:

- Read-only API keys

- Encrypted offline backups

- Local-only data storage options

“The safest tax report is one you can regenerate anytime, without relying on a single platform,” said a compliance officer at a 2025 fintech panel.

Ultimately, balancing centralization for accuracy with decentralization for security is shaping the future of crypto tax infrastructure.

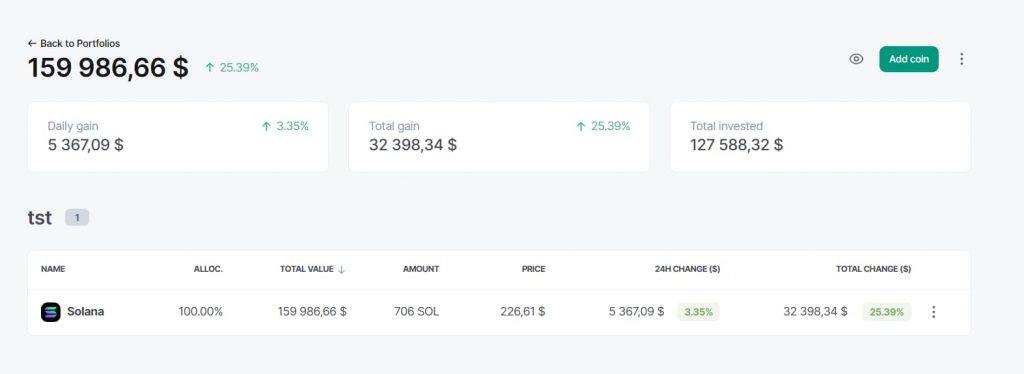

1. CoinDataFlow

https://coindataflow.com/en/portfolio-tracker

Amid the crowded landscape of crypto tax tools, CoinDataFlow makes one clear promise – take the panic out of tax season and replace it with precision. While many platforms pile on features, CoinDataFlow keeps its focus sharp: maintaining data integrity by aligning transactions, resolving inconsistencies, and providing a clean, reliable view of your taxable activity.

Automated tracking of realized/unrealized PnL with cost-basis accuracy

At the core of CoinDataFlow’s tax toolkit is an automated profit and loss (PnL) engine. It connects with your exchanges and wallets, tracks every buy and sell event, and calculates the precise cost basis using whichever accounting method you choose – FIFO, LIFO, or average cost.

What sets CoinDataFlow apart is its smart reconciliation logic. Instead of simply importing data, it actively scans for errors like duplicate entries, missing transactions, or mismatched records – often caused by manual edits or sloppy exchange exports. This level of checking dramatically reduces the chance of tax errors, overpayment, or triggering an audit.

| Function | Description | Tax Relevance |

| Realized gain calculation | Detects taxable events automatically | Helps avoid missed disposals |

| Unrealized tracking | Tracks holdings using live market prices | Useful for capital gains forecasting |

| Cost-basis standardization | Syncs FIFO/LIFO rules across sources | Prevents inconsistent reporting |

| Fee and gas recognition | Includes trading and network fees in reporting | Maximizes deductible expenses |

By merging your trade history with live market prices, CoinDataFlow creates a full timeline for each asset – essentially generating a paper trail that’s ready for filing or third-party review.

“I used to spend Saturdays cleaning up CSVs,” one trader posted on Reddit. “CoinDataFlow matched trades from four different exchanges and gave me a clean PnL report in under an hour.”

It’s not just about speed – it’s about trust. With accurate gain tracking and clear audit trails, users can finally feel confident in the numbers they’re reporting.

Advantages: transparent data model, multi-platform sync, CSV-ready reporting

When it comes to tax prep, clarity beats complexity. CoinDataFlow’s interface gives users a clear view of every taxable event and lets them filter data by year, asset, or transaction type. Each line item links back to its source – whether it’s a trade, wallet transfer, or DeFi transaction.

Key benefits include:

- Syncs data from both centralized and decentralized platforms

- Shows data lineage so users can trace every number to its source

- Automatically converts crypto to fiat at transaction time

- One-click CSV/Excel export compatible with tax software and national filing formats

| Data Category | Visibility Level | Export Compatibility |

| Spot trades | Full detail with timestamps | ✅ CSV / XLSX |

| Staking rewards | Market value conversion | ✅ Tax import templates |

| Gas/network fees | Auto-tagged by transaction type | ✅ Deduction columns |

| DeFi interactions | Token-level detail | ✅ Raw log export |

Instead of forcing users to learn complex tax terminology, CoinDataFlow focuses on transparency – showing how numbers are calculated, not hiding them behind black boxes. This is especially valuable for users who want to double-check numbers before handing them off to accountants or tools like TurboTax and TaxBit.

A standout feature is the platform’s multi-year view, which visualizes your gains, losses, and holding periods – allowing you to apply strategies like tax-loss harvesting or long-term gain qualifications more effectively.

Limitations: lacks direct tax filing integration but ideal for pre-filing reconciliation

CoinDataFlow intentionally avoids acting as a full-service tax filing platform. It doesn’t submit forms directly to tax agencies or generate jurisdiction-specific paperwork like Form 8949 (US) or the HMRC Capital Gains Summary (UK). Instead, its strength lies in preparing clean, structured data sets that you can plug into other tools.

| Limitation | Explanation | Workaround |

| No direct e-filing | No option to submit returns from within the app | Export to third-party tax tools |

| Limited local templates | Doesn’t auto-fill national tax forms | Outputs raw, mappable data |

| No accountant collaboration | Lacks built-in multi-user workflow | Secure CSV sharing via link |

This focused approach actually works in CoinDataFlow’s favor. By sticking to reconciliation – not tax filing – it avoids regulatory complications while still delivering rock-solid, verifiable data.

“Filing is easy when your numbers are right – and CoinDataFlow finally made mine accurate,” one user noted in a forum discussion.

Bottom line: CoinDataFlow doesn’t claim to file your taxes. It ensures the numbers you file are correct – and that distinction alone can save you hours and unnecessary tax bills.

2. Coinexplorers

https://coinexplorers.com/portfolio

For crypto newcomers looking for a straightforward way to track their portfolios, Coinexplorers offers a refreshingly simple solution. Rather than burdening users with complicated imports, deep reconciliation workflows, or technical tax tools, it delivers a clean snapshot of your holdings and price movements. It’s tailor-made for those who trade occasionally and just want to keep an eye on their asset values – without getting lost in complex tax logic.

Simplicity for casual investors

The strength of Coinexplorers is its minimalism. Once you connect a wallet or add tokens manually, it generates a live snapshot of your portfolio value. No long sign-up process or API keys required – just an immediate, auto-updating summary based on public market prices.

| Feature | Description | Target User |

| Wallet tracking | Syncs via public address | Beginners with long-term holdings |

| Price feed integration | Pulls in real-time market data | Passive investors |

| ROI visualization | Shows growth since purchase | Users testing crypto exposure |

| Multi-asset dashboard | Supports major coins | Casual portfolio watchers |

“I didn’t want to set up another API key or deal with forms – Coinexplorers took two minutes,” one Reddit user said. “It feels like a dashboard made for people who hate dashboards.”

While other platforms push automation and compliance, Coinexplorers is all about clarity – giving investors a sense of control without drowning them in data.

Pros: free use, minimal setup

Coinexplorers is 100% free with no premium tiers or gated features. Its main advantage is its instant accessibility – users can get started immediately, without syncing exchanges or handing over sensitive keys.

Key strengths:

- No registration friction – use it anonymously with full functionality

- Privacy by design – stores portfolio data locally or via read-only sync

- Simple interface – clean numbers, no complicated labels

- Instant overview – loads quickly even with large token lists

| Category | Strength | Why It Matters |

| Usability | Plug-and-play setup | Reduces complexity for new users |

| Security | No trading permissions | Safer for beginners |

| Cost | Completely free | Accessible for all |

| Transparency | No ads or banner clutter | Keeps the data view clean and neutral |

This stripped-down approach is especially attractive to long-term holders of Bitcoin or Ethereum – people who check their portfolio performance now and then, but don’t trade daily.

Cons: lacks advanced tax and compliance metrics

The same simplicity that makes Coinexplorers appealing also makes it unsuitable for detailed accounting. It doesn’t track cost basis, flag taxable events, or export structured data suitable for audits or official tax filings. If you trade often or use multiple blockchains, these gaps quickly become a limitation.

| Limitation | Description | Impact |

| No transaction history import | Manual entry only | Incomplete records |

| No cost-basis logic | Can’t distinguish realized/unrealized gains | Crude tax estimates |

| No CSV or tax export | Snapshot only | Requires external reconciliation |

| No DeFi or NFT tracking | Token balances only | Incomplete portfolio visibility |

Because of this, Coinexplorers often serves as a “starter tool” – a first step before users graduate to more advanced platforms as their portfolios (and tax responsibilities) grow.

“It’s a great balance sheet app, not an accountant,” one community reviewer wrote.

In short, Coinexplorers sacrifices power for peace of mind. It’s a great fit for users who value simplicity, privacy, and zero setup over in-depth reporting. But if you’re trying to minimize taxes or meet regulatory standards, this is more of a sneak peek – not the full picture.

3. Koinly

https://koinly.io/crypto-portfolio-tracker/

When it comes to automated crypto tax reporting, Koinly is often the first name mentioned – and for good reason. It’s widely seen as one of the most complete and dependable tools for calculating crypto taxes, combining deep exchange integrations with built-in tax form generation for multiple countries. Koinly’s mission is straightforward: handle the heavy lifting, from transaction import to tax-ready reporting.

The benchmark for automated crypto tax software

Koinly is built to eliminate the pain points between trading and tax compliance. It syncs directly with exchanges, wallets, and blockchains to import all your transactions and classify them according to your local tax rules. Whether it’s a spot trade, DeFi yield, or NFT sale, the platform tries to automatically determine the correct tax treatment.

| Integration Type | Examples | Automation Level |

| Centralized exchanges | Binance, Coinbase, Kraken | Full API sync |

| Wallets | MetaMask, Ledger, Trust | Address scanning |

| DeFi protocols | Aave, Curve, Uniswap | Smart-contract parsing |

| NFT platforms | OpenSea, Blur | Metadata tagging |

| Tax filing systems | IRS, HMRC, CRA, ATO | Country-specific formats |

Koinly also supports multiple cost-basis methods – FIFO, LIFO, HIFO, adjusted average – and lets you switch between them instantly to see how each affects your tax outcome. This flexibility is a huge asset when optimizing your tax position.

“Koinly saved me from paying twice on the same ETH swap,” one user shared on Twitter. “It tracked all my cross-chain moves and reconciled my bridge transfers perfectly.”

In many ways, Koinly has set the gold standard for crypto tax automation – proving that clean data and ready-to-file output can go hand-in-hand.

Pros: auto-generated tax forms, cost-basis accuracy

What users love about Koinly is the complete end-to-end process. Once accounts are linked, generating reports is plug-and-play. It doesn’t just summarize – it produces official tax forms that can be filed directly or imported into tools like TurboTax, TaxSlayer, or local filing systems.

Key benefits include:

- Automatic generation of tax forms (Form 8949, Schedule D, HMRC summaries, ATO reports, etc.)

- Accurate cost-basis tracking across all exchanges and wallets

- Clear separation between income and capital gains

- Pre-filing liability previews, allowing you to time disposals

- Smart alerts for missing or duplicated transactions

| Feature | Benefit | Ideal Use Case |

| Auto tax form creation | Ready for filing or e-file upload | Retail and pro traders |

| Multi-country support | Compliant with regional formats | Cross-border users |

| Fee inclusion | Deducts trading and gas costs | High-frequency traders |

| Profit dashboard | Tracks liabilities in real-time | Year-round tax planning |

Koinly also handles DeFi smartly – parsing contracts to automatically detect taxable events like swaps, staking rewards, or liquidity withdrawals, which many other tools struggle to classify correctly.

Cons: high subscription tiers, limited free features

All of Koinly’s power comes at a price. The free plan allows you to import and preview data, but if you want to generate tax reports, you’ll need to upgrade. While the pricing is fair for serious users, small-time traders may find it steep.

| Tier | Price (USD/year) | Limitations |

| Free | $0 | No tax form export |

| Newbie | $49 | 100 transactions |

| Hodler | $99 | 1,000 transactions |

| Trader | $179 | 10,000 transactions |

| Pro | $279 | Unlimited + priority support |

Another issue is that Koinly’s integrations can lag behind fast-moving DeFi protocols or new NFT platforms. Until official support is added, some transactions must be entered manually.

Some users also report that when you import new data, the software may override custom edits, requiring a second round of manual review – especially for complex portfolios.

“I trust it for 90% of my trades,” one crypto investor noted on a forum. “The last 10% still needs a human double-check.”

Final verdict

Despite its price and minor quirks, Koinly remains a top-tier solution for anyone who values automation, precision, and global tax compliance. Its ability to generate filing-ready documents and manage both CeFi and DeFi data makes it an essential tool in the modern crypto investor’s toolkit.

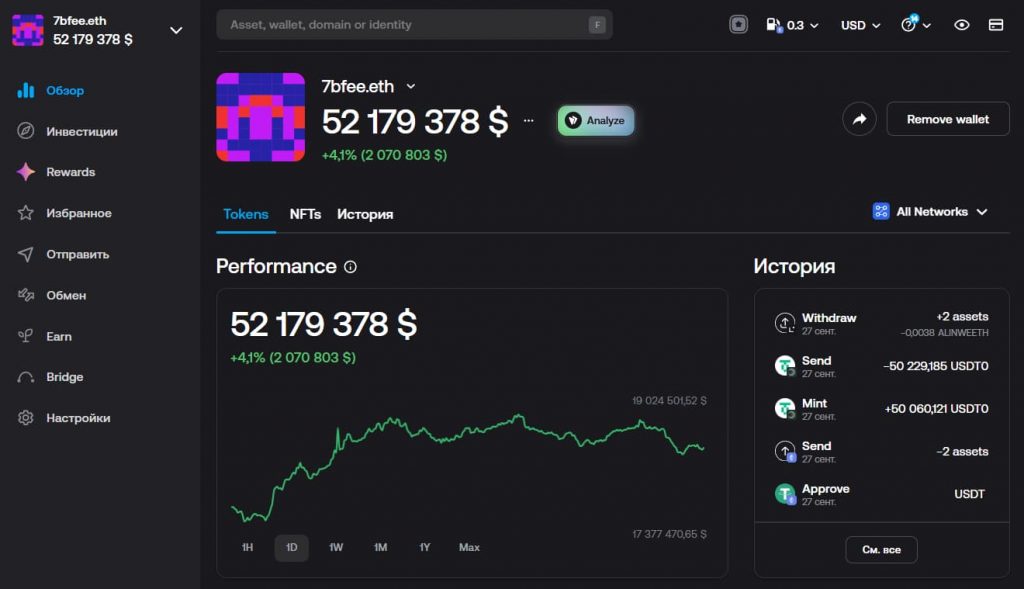

4. Zerion

Zerion has become a go-to tool for investors who are more active in decentralized protocols than centralized exchanges. Initially created as a DeFi portfolio tracker, it has evolved into a robust tool that gives users clarity into the tax impact of on-chain activity. While it doesn’t generate full tax reports, its detailed breakdowns of transactions and asset histories help users stay on top of potential tax liabilities well before tax season hits.

DeFi-oriented tax awareness

Zerion excels where many traditional tax tools fall short – interpreting real-time blockchain data. It connects directly to user wallets, aggregates token balances, liquidity positions, and yield earnings, and displays them alongside transaction history and entry prices.

What makes this especially useful for tax purposes is Zerion’s ability to clearly identify each wallet event – including swaps, staking rewards, airdrops, and NFT mints – as distinct actions, each with its own potential tax classification.

| Activity Type | Example Protocols | Potential Tax Impact |

| Liquidity Provision | Uniswap, Curve | Capital gains or losses on LP tokens |

| Yield Rewards | Yearn, Aave | Ordinary income based on value at time of receipt |

| Token Swaps | SushiSwap, Balancer | Disposal of one token, acquisition of another |

| NFT Purchases | OpenSea | Purchase with potential for resale capital gain |

| DAO Rewards | Arbitrum, Optimism | Income, taxable upon receipt |

This approach doesn’t just show you numbers – it helps you understand their meaning. Users can quickly see which activities might trigger a taxable event and which are internal transfers with no tax implications.

“Zerion doesn’t file taxes for you, but it teaches you where your taxes come from,” noted one user in a DeFi community forum.

By making blockchain data easier to interpret, Zerion bridges the gap between raw on-chain activity and the insight required to properly classify that activity for taxes later on.

Pros: real-time visibility of taxable DeFi positions

Zerion’s biggest strength is its up-to-the-second clarity. It syncs directly with blockchain nodes and updates every few seconds, so users always see the most current state of their portfolios and PnL.

Key advantages include:

- Full DeFi visibility – supports Ethereum, Arbitrum, Optimism, BSC, Polygon, and more

- Categorized transaction feed – helps users manually identify taxable vs. non-taxable events

- Multi-wallet support – combine DAO, hot, and cold wallets in one dashboard

- Integrated NFT analytics – includes floor price tracking and transaction history for tax reference

| Feature | Description | Use Case |

| Wallet auto-detection | Instantly reads connected wallets | Ideal for multi-chain users |

| Token activity labeling | Tags each transaction type | Useful during manual tax prep |

| Price history timeline | Shows how values changed over time | Helps separate realized/unrealized gains |

| Exportable reports | Basic CSV for use in other tools | Good for manual tax workflows |

Because of this depth, Zerion is a favorite among DeFi power users and yield farmers who need to stay alert to taxable income from staking, rewards, or DAO payouts.

Cons: missing CEX integrations and export formats

Zerion’s laser focus on DeFi also creates limitations. It doesn’t support centralized exchange (CEX) APIs, so users who trade on platforms like Binance, Coinbase, or Kraken must track that data separately.

| Limitation | Description | Effect |

| No CEX API integration | Can’t pull data from Binance, Coinbase | Incomplete portfolio overview |

| Basic export options | CSV only, no tax-ready format | Manual data transfer required |

| No cost-basis automation | Doesn’t apply FIFO/LIFO rules | Requires external tools to calculate |

| No direct tax reports | Awareness tool, not a filing solution | External reconciliation still needed |

Because of this, Zerion works best as part of a hybrid approach – serving as your DeFi data source while you use another platform to reconcile and file everything. Many users export Zerion logs into another tool that merges DeFi and CEX activity for a full tax report.

“If your taxes start on-chain, Zerion is your map,” one community member joked. And that captures it perfectly.

Zerion isn’t built to file your taxes – it’s built to give you foresight. By clearly laying out your DeFi moves in a digestible format, it empowers users to understand the tax consequences of their yield farming, NFT trades, and governance rewards well before tax time.

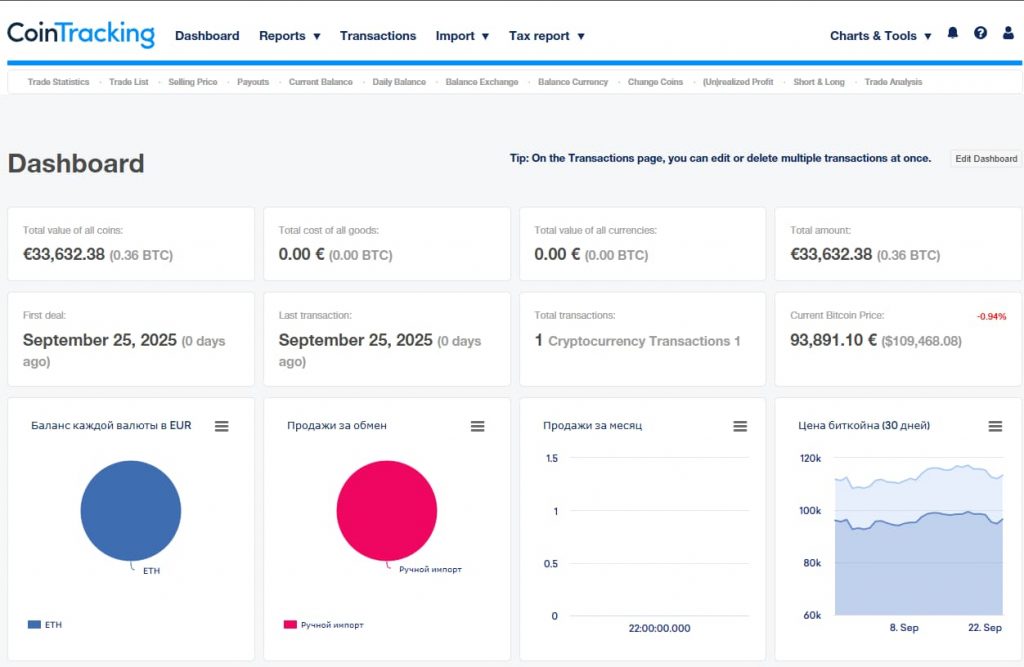

5. CoinTracking

CoinTracking is a veteran name in the crypto accounting world – and that legacy shows. While newer tools focus on flashy interfaces and user-friendly design, CoinTracking is tailored for serious power users who care about depth, historical accuracy, and audit-grade documentation. With native support for over 25,000 coins and robust import capabilities, it’s built for investors who treat their crypto activity like a business.

The veteran platform for accounting and tax documentation

CoinTracking delivers unmatched depth when it comes to parsing and managing transactions. You can import data from more than 110 exchanges, label each transaction by activity type (e.g., mining, airdrops, margin trading, gifts), and generate nearly any kind of report a regulator or accountant could request. It supports all major accounting methods – FIFO, LIFO, HIFO, and average cost – and lets you switch between them per portfolio.

| Feature | Description | Compliance Role |

| Exchange import | API and CSV uploads from 110+ platforms | Builds accurate trading history |

| Wallet integration | Pulls from public addresses | Includes hot and cold wallets |

| Tax report generator | Region-specific formats for 100+ countries | Ready for submission |

| Audit documentation | Chronological logs, receipts, and backup files | Meets 5+ year retention standards |

A standout feature is its balance reconciliation engine – a forensic-level tool that compares imported transaction data to wallet balances and flags discrepancies. For investors with complex, multi-platform histories, this is invaluable.

“CoinTracking gave me a full picture – down to every last sat,” said a long-term Bitcoin holder. “It was the only tool that could handle my Mt. Gox archive and DeFi history in one view.”

Pros: comprehensive reporting, import/export versatility

CoinTracking’s biggest advantage is flexibility. It supports nearly all asset types and transaction categories, allowing users to generate custom reports for personal, professional, or institutional use.

Key benefits include:

- CSV and API imports from now-defunct exchanges

- Full support for NFTs and DeFi with token-level details

- More than 25 customizable report formats (e.g., unrealized gains, income statements, donation records)

- Export compatibility with tax and accounting tools like Excel, TurboTax, Xero

| User Type | CoinTracking Fit | Why It Works |

| Early adopters | Supports altcoin and ICO history | Covers data from 2013 through 2025 |

| High-volume traders | Handles 100,000+ transactions | Optimized for speed and bulk data |

| Accountants & pros | Offers categorized reports by type | Meets strict documentation needs |

Its capital gains simulator is another useful feature, allowing users to test tax scenarios under different sale dates or accounting methods – helpful for end-of-year planning.

Cons: dated interface and complex setup for newcomers

The downside of all this functionality is a steep learning curve. CoinTracking’s design feels outdated, and the interface can be overwhelming for casual users. Initial setup – especially when importing data from multiple platforms – requires care and time.

| Issue | Description | User Impact |

| Legacy interface | Outdated menus and layout | Slows down learning for new users |

| Manual data cleanup | Some entries need custom tagging or edits | Lengthy onboarding for large portfolios |

| DeFi complexity | No automatic parsing of smart contract data | Requires manual entry for many actions |

| Subscription tiers | Limits based on transaction volume | Pro plan required for big portfolios |

CoinTracking isn’t built for casual investors making a few trades a year. But for high-volume users, tax professionals, and anyone needing airtight audit records, it remains one of the most capable tools available.

Its reputation isn’t just about longevity – it’s about capacity. No other platform comes close to CoinTracking’s forensic-level control and historical scope.

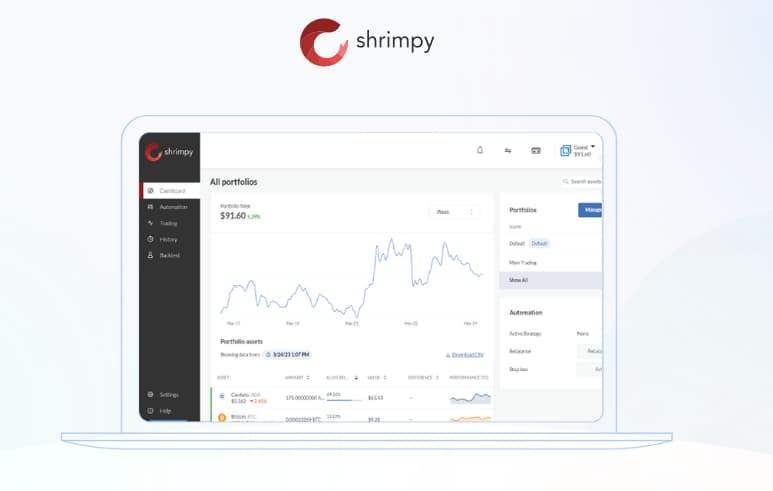

6. Shrimpy

Shrimpy wasn’t originally built for tax purposes – it was designed with trading strategy in mind. As one of the first crypto rebalancing platforms, its main goal was to help users stick to their risk profile by automatically realigning portfolios over time. But this functionality also led to frequent taxable events, which unintentionally made Shrimpy a helpful tool for tax awareness – even though it still lacks built-in tax filing features.

Automated portfolio rebalancing with implicit tax triggers

At its core, Shrimpy functions as an automated trading engine that adjusts your holdings based on predefined allocations. For example, if your goal is a 50/50 split between Bitcoin and Ethereum, Shrimpy will continuously rebalance your portfolio to maintain that target – regardless of price changes.

While great for maintaining strategy, this automation creates regular taxable events. Every rebalance involves selling and rebuying assets, meaning capital gains (or losses) are realized each time. Shrimpy doesn’t calculate these gains or generate tax reports, but it does provide a real-time trading log.

| Feature | Description | Tax Relevance |

| Rebalancing automation | Periodic redistribution of assets | Triggers taxable disposals |

| API exchange sync | Real-time trades on major CEXs | Accurate timestamped data |

| Trade ledger | Logs all buys and sells | Reference for gain/loss calculations |

| Portfolio tracker | Historical target vs. actual allocations | Supports intent-based audit defense |

Many users export their Shrimpy transaction logs to platforms like Koinly or CoinTracking to calculate capital gains. Others use it to get a better sense of how much PnL (profit and loss) activity their rebalancing strategy is generating.

“I didn’t realize how many taxable events I was triggering until I used Shrimpy,” one long-term user shared. “It’s eye-opening when you see every trade spelled out.”

Pros: integrated trade history for PnL review

Shrimpy is one of the few strategy-first platforms that logs a detailed record of every trade it executes during rebalancing. This visibility is vital for reconciling year-end gains or defending your strategy to a tax authority.

Key benefits:

- Full transaction history for each rebalance

- Exchange-level timestamps via API integrations

- Historical summaries broken down by asset pair

- CSV export for use in tax software

| Strength | Description | Why It Matters |

| Execution transparency | Trade-by-trade detail | Crucial for audit compliance |

| Strategy documentation | Shows reasoning behind rebalancing | Supports intent-based tax reporting |

| Cross-platform syncing | Works with Binance, Coinbase Pro, KuCoin | Consolidates trading activity |

| Raw data export | Full portfolio and trade logs | Supports manual gain/loss tracking |

This level of traceability is essential for power users who rely on automated rebalancing as a core part of their trading strategy. It also gives accountants insight into the logic behind trades – which is key for defending positions during an audit.

Cons: lacks native tax report generation

Despite offering detailed trade visibility, Shrimpy does not generate tax forms, track realized vs. unrealized gains, or apply FIFO/LIFO accounting methods. It doesn’t classify transactions by jurisdiction or compute final tax liabilities. It’s more of a preparatory tool than a complete filing solution.

| Limitation | Explanation | Impact |

| No tax reporting engine | Doesn’t calculate capital gains | Requires third-party tax software |

| No realized/unrealized split | Only provides a flat transaction log | Must manually track gains/losses |

| No accounting method support | Doesn’t use FIFO, LIFO, or HIFO | No tax optimization options |

| No jurisdiction templates | Doesn’t output country-specific forms | Needs export to another filing platform |

That said, Shrimpy still plays a valuable role in a broader crypto tax stack. By providing clean, timestamped records of every rebalance and trade, it helps users stay aware of their tax impact long before filing season arrives.

In that way, it serves as a bridge between trading strategy and tax responsibility – one automated trade at a time.

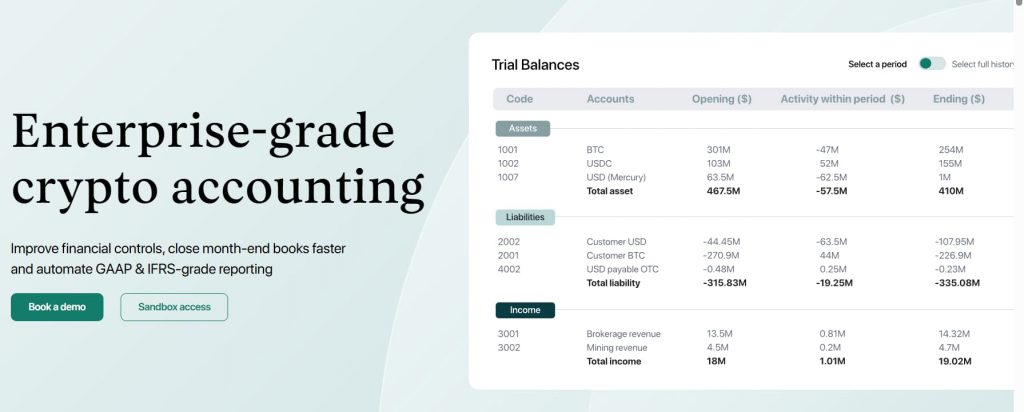

7. Cryptio

Cryptio is tailored for CFOs, accountants, and auditors – not casual traders. As an institutional-grade crypto accounting platform, it goes well beyond simple portfolio tracking or tax estimation. Designed to bring Web3 transactions in line with traditional finance standards, Cryptio emphasizes audit readiness, precise reconciliation, and scalable compliance.

Institutional-grade crypto accounting suite

Cryptio pulls data from exchanges, wallets, and blockchains, then transforms it into double-entry journal entries compatible with traditional financial software like QuickBooks, Xero, and Netsuite. Each transaction is processed using formal accounting logic – debits, credits, general ledger accounts, and time-based revenue recognition.

| Source | Integration Type | Financial Output |

| Exchanges | API and CSV import | Trade PnL, transaction ledger |

| Wallets | Public address scan | Token balances and transfers |

| Blockchains | Node integration | Smart contract events |

| DeFi platforms | Custom parsers | Liquidity, staking, farming logs |

| NFTs | Metadata mapping | Collection- and token-level history |

Because of this accounting-native design, Cryptio helps businesses align their crypto activity with fiat-based accounting books, enabling GAAP and IFRS-compliant reporting.

“Most tools talk about taxes. Cryptio talks about audits,” said the CFO of a Web3 fund.

Pros: audit-ready, GAAP-compliant reconciliation

Cryptio’s real strength is its ability to speak the language of accountants. Rather than just tagging transactions, it turns them into official ledger entries suitable for financial reports and regulatory compliance.

Key capabilities:

- Real-time ERP integration for month-end closing

- Customizable chart of accounts for each entity

- Historical pricing and FX conversion for every transaction

- Built-in approval workflows for financial controllers

| Feature | Benefit | Use Case |

| Double-entry ledger | Converts transactions to journal entries | CPA teams and financial auditors |

| Entity-level tagging | Separates activity by fund/account/region | Multi-entity accounting |

| Audit logs | Immutable change tracking | SOX compliance and transparency |

| ERP integration | Sync with Xero, QuickBooks, Netsuite | Smooth month-end reconciliation |

Cryptio also supports auditor access, enabling external reviewers to trace every transaction back to its blockchain origin – complete with notes and documentation.

Cons: too complex and costly for individual users

With enterprise-grade functionality comes enterprise-level complexity. Cryptio is not intended for casual traders – its pricing, terminology, and interface all assume a dedicated finance team.

| Limitation | Impact | Reason |

| High cost | Enterprise-only pricing model | Built for organizations, not individuals |

| Steep learning curve | Requires accounting knowledge | Interface uses advanced GL structures |

| No tax form generation | Can’t file retail tax returns | No Form 8949 or TurboTax support |

| Limited DEX/NFT coverage | Focuses on major protocols | Smaller chains require manual mapping |

For individual investors, Cryptio will likely feel excessive. But for DAOs, crypto-native businesses, and token issuers, it’s often the only tool that delivers audit-grade clarity, financial structure, and compliance at scale.

As one finance lead put it:

“We didn’t need a dashboard. We needed a ledger.”

Insights from the Comparison

Each instrument in this comparison addresses a distinct piece of the crypto tax puzzle – from recreational tracking to institutional compliance. But viewed side by side, they show larger trends about why so many investors underpay (or underreport) and how automation is transforming crypto accounting.

Why they overpay mostly due to broken data

The most frequent reason for overpayment is lost or repeated transaction information. When an exchange or a wallet is not properly synchronized, taxable events get recorded twice – or not at all – resulting in overstated liabilities or audit anomalies.

Examples:

- A user sells ETH on a specific exchange but does not import that terminal – triggering a phantom gain.

- Same airdrop is marked by two wallets, doubling income.

- A transfer across a bridge shows up as a disposal on a chain, but not as a purchase on the other.

Without common data, these inconsistencies accumulate. Taxpayers either overwrite too much or spend hours repairing spreadsheets they can’t comprehend. And while tax agencies are still catching up, many now have blockchain analytics programs that highlight inconsistencies right away.

How cross-platform automation reduces audit risk

Least-risk platforms are not necessarily the ones with the maximum number of features – they are the ones with simple, consistent data. Software such as Koinly and CoinTracking have less exposure to errors by:

- Standardizing exchange rates and time zones across platforms

- Marking internal transfers not to disguise disposals

- Settling wallet accounts to avoid phantom transactions

- Extension of standardized cost-basis logic to every transaction

When this work is automated, investors have less time patching up CSVs and more time scanning reports they can rely on. This also lets experts (lawyers, accountants, CFOs) catch edge cases fast – rather than having to manually verify each wallet.

Why pre-filing reconciliation tools like CoinDataFlow matter

Even if a platform does not directly file taxes, it can also have a significant role to play in compliance. Solutions such as CoinDataFlow do not file the returns, but they ensure that the figures that enter the return are correct.

Pre-filing reconciliation tools are particularly useful since they:

- Mark inconsistencies prior to their fixation into reports

- Present neat PnL statements that correspond to particular wallets

- Allow users to preview how various cost-basis methods impact liability

- Assist investors in preparing their information prior to calling in an accountant

But at this middle level – between grossed-up blockchain data and actual tax forms – is where the true wizardry occurs. Here is where overpayment is averted, audits are prevented, and investors are able to gain clarity into their digital obligation.

FAQ

How is tax reporting different from financial tracking?

PnL tracking (profit and loss) shows how your portfolio’s value changes over time. Tax reporting, however, calculates your taxable gains or losses according to legal rules. You could have a positive PnL and owe nothing – or a negative PnL but still owe taxes if gains were realized earlier.

How do automated tools estimate cost basis?

These tools match each asset you sell with the original price you paid, using accounting methods like FIFO (first in, first out) or LIFO (last in, first out). The difference between those two prices determines your taxable gain or loss.

Are DeFi transactions taxable?

Yes. DeFi activities like swaps, staking, yield farming, and reward-based actions are considered taxable in most jurisdictions. Even if you haven’t converted your crypto to fiat, you may still owe taxes on the value gained.

Can I use free tools for tax preparation?

Yes – but with some limits. Free plans usually provide dashboards and summaries only. If you need detailed CSV exports or official tax forms, you’ll likely need a paid subscription.

Which services integrate directly with tax agencies?

Platforms like Koinly can export data directly to agencies such as the IRS and HMRC. Some also integrate with TurboTax or TaxSlayer for U.S. taxpayers.

What’s the safest way to export portfolio data for filing?

Use read-only API keys or CSV exports. Never grant withdrawal or full-access permissions. Always review exported data for missing, duplicated, or incorrect entries before submitting your tax forms.

Conclusion

Crypto taxation is no longer a sideline concern – it’s an essential part of responsible investing. As regulations grow stricter and data-sharing between exchanges and tax authorities expands, accurate reporting is no longer optional. The good news is that automation is closing the gap between blockchain complexity and financial compliance.

For casual investors, simple dashboards like Coinexplorers or CoinDataFlow provide clear overviews without complexity. For active traders, tools like Koinly and CoinTracking ensure accurate reconciliation so that no trade slips through the cracks. And for institutions, Cryptio brings enterprise-grade accounting discipline to the Web3 ecosystem.

The key takeaway? Don’t wait for tax season to organize your data. Automate your tracking, verify your cost basis regularly, and use pre-filing reconciliation tools to avoid overpaying. In crypto, precision doesn’t just protect profits – it brings peace of mind.